Time-Focused Retention Marketing

Overview

“Time is money.” Every business person knows this age old adage.

Retention marketers have always been focused on the element of time, concentrating on the delivery of the right message to the right person at the right time. It is a kind of de facto mission statement..

The measures of success for the direct marketing community have also relied on the time-based concepts of return on investment (ROI) for their response and acquisition efforts, Recency/Frequency/Monetary (RFM) for cross-sell and dialogue-building programs, and customer lifetime value (LTV) for loyalty marketing. These metrics are the building blocks for the catalogue, automotive, financial services, high tech, retail and insurance businesses.

Today’s retention marketer is able to leverage many customer relationship management (CRM) oriented technologies that were not available a decade ago. Enterprises throughout the world are recognizing the need for true customer-oriented databases that can provide the insight needed to develop loyal, multi-product customers. This has required that they successfully weld together many succinct new technologies, including data warehousing, customer segmentation software, Marketing Automation and CRM facing applications.

This infrastructure must support a diverse ecosystem of end users, including product managers, advertising managers, direct marketing and digital practitioners, external advertising agencies and media buying companies. This can be a daunting task. I like to make a chef analogy, who not only understands the raw ingredients (data) required for each recipe (channel application), but also has complete command of the pots (data warehouse), stove (marketing budget and bandwidth), and knifes (data slicing) to assemble the final meal to order (marketing communication) to a hungry client base (end customer). How a chef becomes famous is in the subtle touches, not overcooking the meal (list fatigue), delivering an attractive menu (relevant offers) in context to the cuisine (company’s product and service offerings), and all served piping hot from the kitchen.

The intent of this article is to highlight a new generation of enabling CRM technologies and processes, which will greatly enhance time-focused retention-based database marketing. They are designed to reduce the end user knowledge needed to integrate these infrastructure components. KSL Media Inc’s Retention Practice represents the next wave of thinking that will ultimately provide the innovative marketing organization with a flexible way to maximize customer value over time.

The 24 Day in the Life of a Customer

KSL believes the current CRM approach is flawed. Enterprises are expected to commit significant financial resources against IT technologies and software that have little to do with answering the basic questions of “Who is My Best Customer?” and “How do I reach them?” These questions should be at the core of any outreach program. All IT solutions take a uniform approach that all database consumers should be captured equally, stored equally, and spoken to using only 1 to 1 techniques such as outbound direct mail, telemarketing or email.

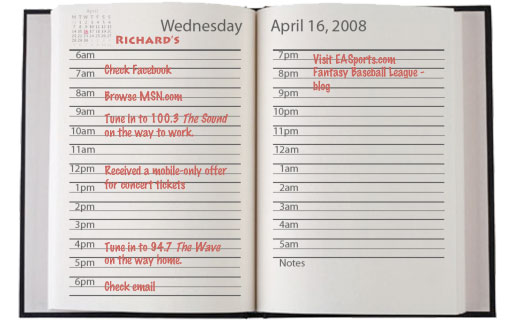

We look at all media, which can be outbound or inbound, to ensure that relevant offers are delivered where these individuals spend their day. For example, in terms of media usage, I freely switch channels in a course of my day: I am on Facebook and MSN in the morning, listen to AOR and Indie Rock radio on the drive in to work, spend my workday glued to my cell phone, listen to Smooth Jazz on the drive home, read the day’s mail before dinner, than visit my blogs and content sites. I have seven logical touch points to reach me in a 24 hour period. All are relevant. Most CRM approaches would limit contact solely to emailing my MSN account or sending a direct mail piece sent to my personal postal address, dictated by the outreach capabilities of the software. So I will only be effectively reached 29% of the time.

Our approach has evolved by putting a greater emphasis on customer insight upfront. This insight allows for the construction of coherent dialogue programs based on delivering the right message to the right person ALL of the time.

Using the chef analogy one step further, it would be a restaurant’s dream if we could read the mind of each patron to know their desired order from the restaurant before having to staff, procure food, and expedite a reservation and walk-through list. New media planning and customer clustering tools allow us this insight.

CAP versus CRM: Time-based Profiling

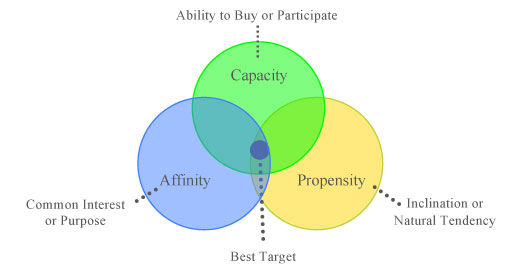

Our simplified approach places a higher value to properly identifying the underlying profile of a customer set, based on capacity, product category affinity, and buying propensity. We call this approach CAP (Capacity, Affinity, and Propensity). All retention monies are then allocated on predicted ability to buy in the future, a true vision of Customer Lifetime Value.

Within the CAP framework, Affinity is always the easiest dimension to focus in on. Your customers speak to their affinity with your product. We simply scrape a client’s master customer file and then take different views of this from a demographic perspective. What is the Top 20% of customers that drive X% Lift in Actual Sales (i.e. KSL has had two clients that match the 80/20 Rule). What channel were they acquired by? At which usage level do they exist (i.e. heavy versus moderate)? By understanding the underlying profile of “best customers”, we can focus on the traits that illuminate affinity buying behavior that suggests where they buy at disproportionate levels.

Once we understand the drivers of Affinity, KSL switches to better understanding Capacity. The idea here is simple: not all customers have the financial means to buy a product from a repeat purchase or up-sell basis. By understanding the relative capacity of an individual, we know when we can logically position a product for resell. Wealth distribution in the US affects all products. We use a variety of resources to determine the future buying capacity by analyzing income, net worth, real estate, automotive, and credit usage. These demographic attributes can then be directly applied to a customer file through data enhancement.

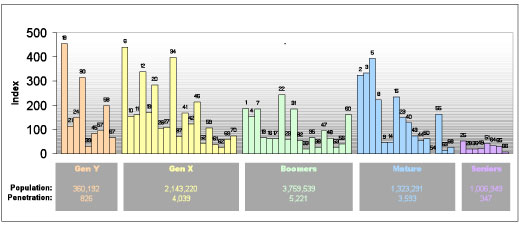

Propensity is the last dimension we look at. We use cluster techniques, linked to life-stage dimensions, generational aging, and surveyed media consumption, to identify where high performing segments consume media. This allows us to anticipate where general awareness meets more traditional direct response techniques.

Very few clients take the time to look at the generational effects of customer aging within their portfolio. Most of KSL’s clients have products that appeal across the spectrum of Gen Y, Gen X, Boomers, Mature and Seniors. What KSL knows is that these segments behave very differently around media consumption. Gen X is a very different audience than Mature and Boomer segments. They are more web and mobile centric. They read more youth-oriented digital media. They don’t read print. They rarely watch television. You would need to speak to them in a different tone, as they don’t believe in explicit brand loyalty passed on from their parents. The current CRM approach can only direct email to them, which now has less than a 1 to 2% open rate for most US retention programs. By surrounding this medium with other relevant media, we can elevate the impressions and weight of the marketing communication to elevate this response.

Retention marketers intuitively know that it is five to ten times more costly to market to a new prospect than market to an existing one. CAP allows the marketer to better target and score customers relative to building deeper relationships. These marketers use this data to predict the sequencing of messaging to continue stimulating cross-sell opportunities within their customer base, as well as understanding the drivers of loyalty and attrition.

Applications of Time Focused Retention Marketing

The author knows of several clients who have benefited from CAP-based strategies:

- For a known hotel chain, identified that 28% of all prospects drove 78% of fractional time-share units offered by the chain within their resort footprint. The elimination of 72% of potential non-responders led to a realized savings of $100k per visit, resulting in savings of many millions of dollars over a three year period. By refocusing marketing dollars to existing clients they were able to increase the average week spent from 2 to 5 paid time-share periods for their most affluent segments.

- For a known financial institution we were able to identify 6 clusters that make up the majority of their high net-worth target. They were able to refocus personal bankers to areas where there were dense clusters of these individuals. Media knowledge of their consumption patterns allowed us to expand their messaging into four channels including television.

- For a major sports franchise, identified current season ticket holders who had the capacity to be upgraded into more expensive packages involving seating, food and beverage and parking options. Sold $700k in new revenue against 2,000 fans.